Your Essential Roadmap to Stress-Free First-Time Home Buying

Are you ready to take the exciting leap into homeownership? Buying your first home is one of the most significant decisions you’ll make in your life, and it can be a thrilling adventure! However, it can also feel overwhelming at times. But don’t worry, with the right roadmap, you can navigate this process smoothly and stress-free.

The first step in your journey is to understand your financial situation. Knowing your income, expenses, credit score, and savings will empower you to make informed decisions. A great starting point is to review your credit report. This will give you insight into your credit history and help you identify areas for improvement. If you spot any errors, now is the time to have them corrected. A better credit score can lead to more favorable mortgage options down the line.

Next, it’s essential to set a realistic budget. Take a look at how much you can comfortably afford to spend on a home. Think about not just the mortgage payment, but also property taxes, homeowner’s insurance, and maintenance costs. It’s wise to stick to a budget that allows for a little wiggle room so you won’t feel financially stretched. Once you have a budget, you’ll be ready to explore your financing options.

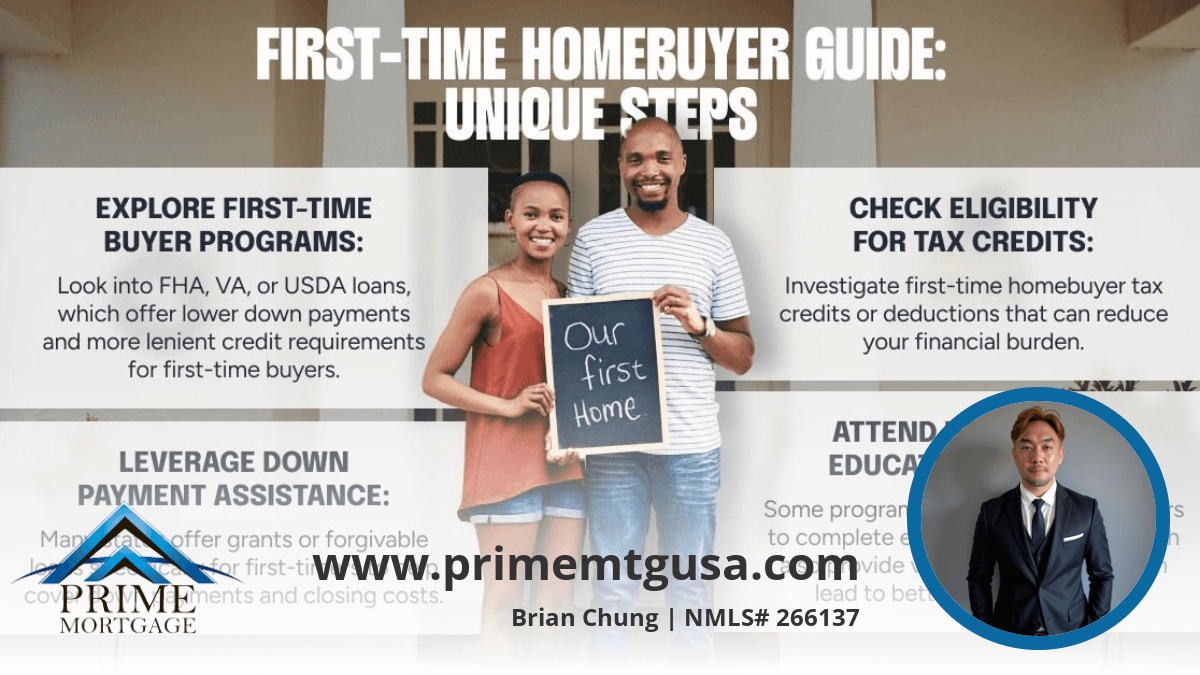

This is where having a knowledgeable mortgage loan officer is invaluable. They will guide you through the various types of mortgages available and help you select the one that fits your needs best. Fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans each have their pros and cons. Your mortgage officer will help explain these options in simple terms, making it easier for you to choose what suits you.

Once you’ve settled on a mortgage type, it’s time to get pre-approved. Pre-approval will give you a clear understanding of how much you can borrow and can make you a more attractive buyer when you start shopping for homes. Sellers often prefer offers from pre-approved buyers because it shows you mean business. This step can set you apart in a competitive market and give you an edge.

With pre-approval in hand, it’s time to start home hunting! Create a list of must-haves and nice-to-haves. This will help you stay focused when looking at potential homes. Think about location, size, and amenities that are important to you. Visiting open houses and scheduling viewings can be exciting and fun. Don’t shy away from asking questions during these visits; it’s your future home, after all!

Once you find a home that feels right, it’s time to make an offer. Your mortgage loan officer will assist you in crafting a competitive offer and guide you through the negotiation process. This step can be nerve-wracking, but remember, you have a professional on your side to help you every step of the way.

After your offer is accepted, you’ll enter the closing phase. This is where all the paperwork is finalized, and you’ll officially become a homeowner! Your mortgage officer will be there to ensure that everything is in order, making this last stage as stress-free as possible.

Throughout this exciting journey, remember that you don’t have to go it alone. Your mortgage loan officer is here to support you and answer any questions you may have. If you’re ready to take the next step or have specific needs you want to discuss, reach out today! Your dream of homeownership is within reach, and we’re here to help you achieve it with confidence and ease. Let’s make your first home buying experience a memorable one!

1477465, UNM Financial Group LLC, 1 Bridge Plaza N, Fort Lee, NJ 07024 (201) 937-8120, Licensed by the N.J. Department of Banking and Insurance, Broker will not make any mortgage loan commitments or fund any mortgage loans. Broker arranges loans with third-party providers.

266137, UNM Financial Group LLC, 1 Bridge Plaza N, Fort Lee, NJ 07024, 201-482-8011, Licensed by the N.J. Department of Banking and Insurance, Broker will not make any mortgage loan commitments or fund any mortgage loans. Broker arranges loans with third-party providers.

Brian Youngmok Chung, Residential Mortgage Loan Originator, 266137, UNM Financial Group LLC,1 Bridge Plaza N, Fort Lee, NJ 07024

UNM Financial Group LLC, 1 Bridge Plaza N, Fort Lee, NJ 07024, 1477465 , Residential Mortgage Loan Company

Brian Youngmok Chung, Residential Mortgage Loan Originator, 266137, UNM Financial Group LLC,1 Bridge Plaza N, Fort Lee, NJ 07024

Get Your

FREE eBOOK