Understanding the Refinance Break-Even Point.

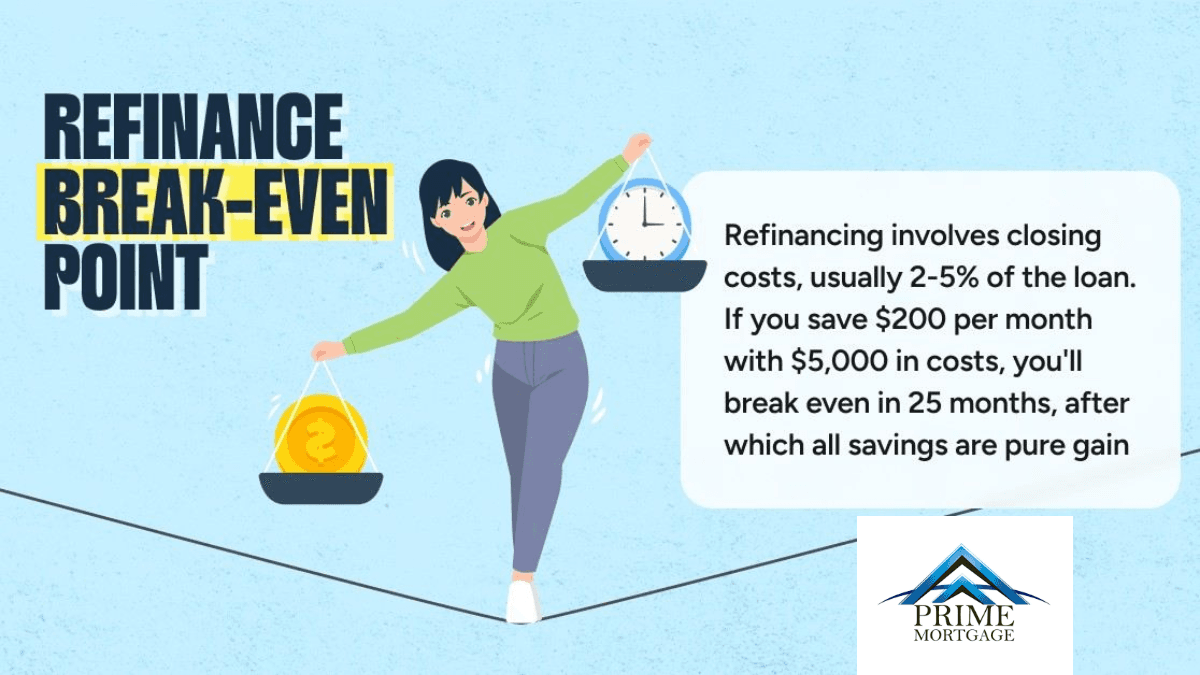

Understanding the Refinance Break-Even Point. Refinancing your mortgage can lead to significant savings, but it's important to know when those savings truly begin. The key is understanding your refinance break-even point. When you refinance, you'll typically incur closing costs, which are usually 2-5% of the loan amount. For example, if you save $200 per month but have $5,000 in closing costs, your break-even point will be 25 months. After those 25 months, every dollar saved becomes pure gain. Calculating this break-even point helps you determine if refinancing is worth the initial costs and how long it will take before you start seeing real financial benefits. Make sure you factor in this important metric when considering a refinance to ensure it aligns with your long-term financial goals.

1477465, UNM Financial Group LLC, 1 Bridge Plaza N, Fort Lee, NJ 07024 (201) 937-8120, Licensed by the N.J. Department of Banking and Insurance, Broker will not make any mortgage loan commitments or fund any mortgage loans. Broker arranges loans with third-party providers.

266137, UNM Financial Group LLC, 1 Bridge Plaza N, Fort Lee, NJ 07024, 201-482-8011, Licensed by the N.J. Department of Banking and Insurance, Broker will not make any mortgage loan commitments or fund any mortgage loans. Broker arranges loans with third-party providers.

Brian Youngmok Chung, Residential Mortgage Loan Originator, 266137, UNM Financial Group LLC,1 Bridge Plaza N, Fort Lee, NJ 07024

UNM Financial Group LLC, 1 Bridge Plaza N, Fort Lee, NJ 07024, 1477465 , Residential Mortgage Loan Company

Brian Youngmok Chung, Residential Mortgage Loan Originator, 266137, UNM Financial Group LLC,1 Bridge Plaza N, Fort Lee, NJ 07024

Get Your

FREE eBOOK